Fraudulent Claims Detection

InsuranceBusiness Impacts

48,00+

Claims analyzed

335+

Potentially suspicious claims identified

20+

Fraudulent claims identified

Customer Key Facts

- Location : North America

- Industry : Insurance

Problem Context

The customer is a specialty insurance company that wanted to understand trends in their data and prepare a model to identify potential fraudulent claims in their workers compensation line of business.

Challenges

- Identify anomalies in the data

- Tag potentially fraud claims based on a set score

Technologies Used

Microsoft SQL Server

Python

TensorFlow

Tableau

Keras

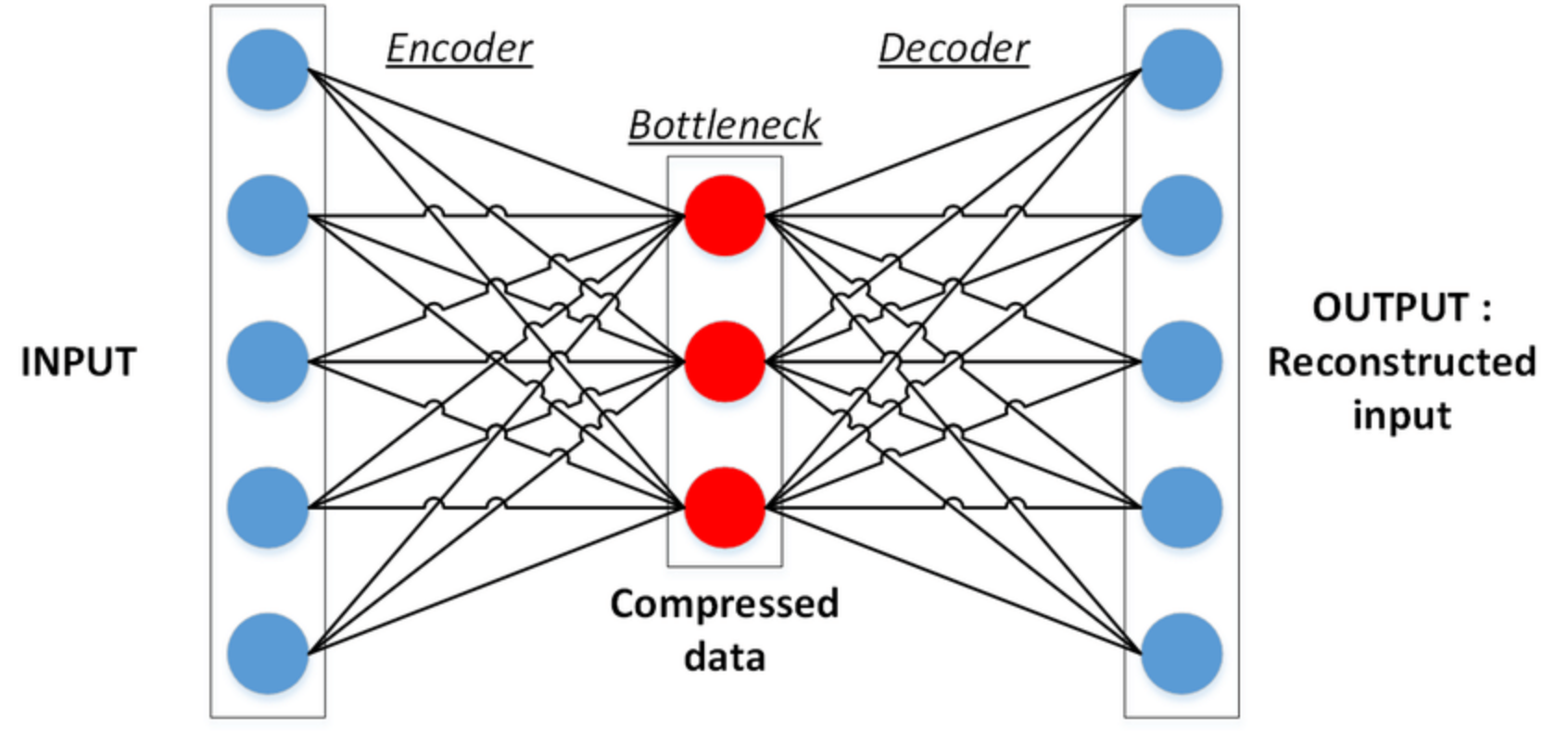

Auto Encoder

Developing a ML model and Rule-based Indicators to Classify Potential Fraudulent Claims

Solution

Quantiphi leveraged various types of the customer's claims-related data, such as Claims note, Claims details, ISO match and Loss run, to train a machine learning model and build a rule/indicators based system to tag potentially fraudulent claims based on a set score. Additionally, we built an unsupervised machine learning model to find anomalies in the data. A Tableau Dashboard was also built to showcase which claims are detected as suspicious.

Result

- Reduced claims payout and expenses owing to identification of fraudulent claims

- Gained the ability to gauge the fraud risk of a claim in real time

- Improved operational efficiency

- Analytics-driven reporting via a BI platform