As the COVID-19 pandemic continues to have social and economic turmoil all over the world, people across the globe are getting used to the so-called “new way of life”. The most visible common denominator right from Japan to all the way to North America is the increased usage of advanced digital technologies and touchpoints to keep critical services afloat. These digital services, which were considered “good to have” until a few weeks ago, are now the new “must-haves”.

Against this backdrop, let’s evaluate the financial services sector and the insurance industry in particular. Of the Holy Trinity, Banking and Capital Markets were the early adopters of digital services and for all practical purposes, had some of the infrastructures in place to react to COVID 19. Contactless payments are a prime example. Banks have been making investments in this touchpoint for a while and the decision is paying rich dividends now.

The Insurance industry (barring a few handful carriers) has always been behind the eight ball when it comes to the adoption of ‘Digital’ and the results are quite humbling in this pandemic.

- Call centers are not modern enough to address worrying customer concerns and show empathy

- Agents and brokers don’t have the right digital tools available at their disposal to manage and retain customers, let alone produce new business

- Also, the claims department and the adjusters aren’t simply equipped well enough to handle the enormous volumes of claims being filed.

Where Are We Headed?

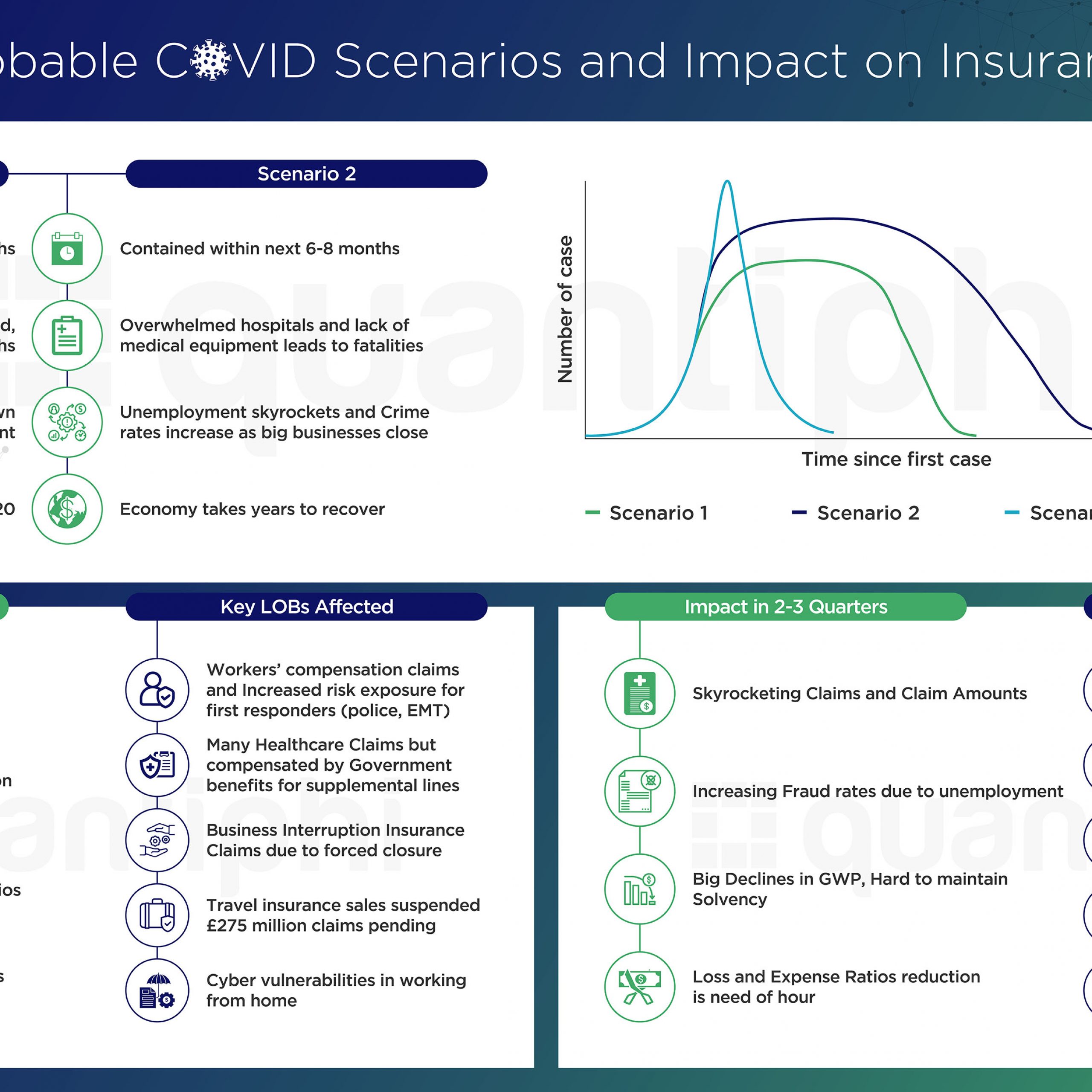

Taking into account the current situation, there are two possible scenarios that insurance companies must brace for

Scenario 1: With strict quarantine, lockdown, and social distancing, the pandemic will be brought under control and there will be a recovery in around two quarters.

Scenario 2: Ineffective lockdown and social distancing measures will lead to a steep increase in cases with a prolonged impact period of around three quarters.

The effect of each of these scenarios in insurance is highlighted in the figure.

Want to know how our AI and ML solutions can help you better prepare for the rapidly evolving future? Explore our insurance solutions now!

How Should The Insurance Industry Prepare?

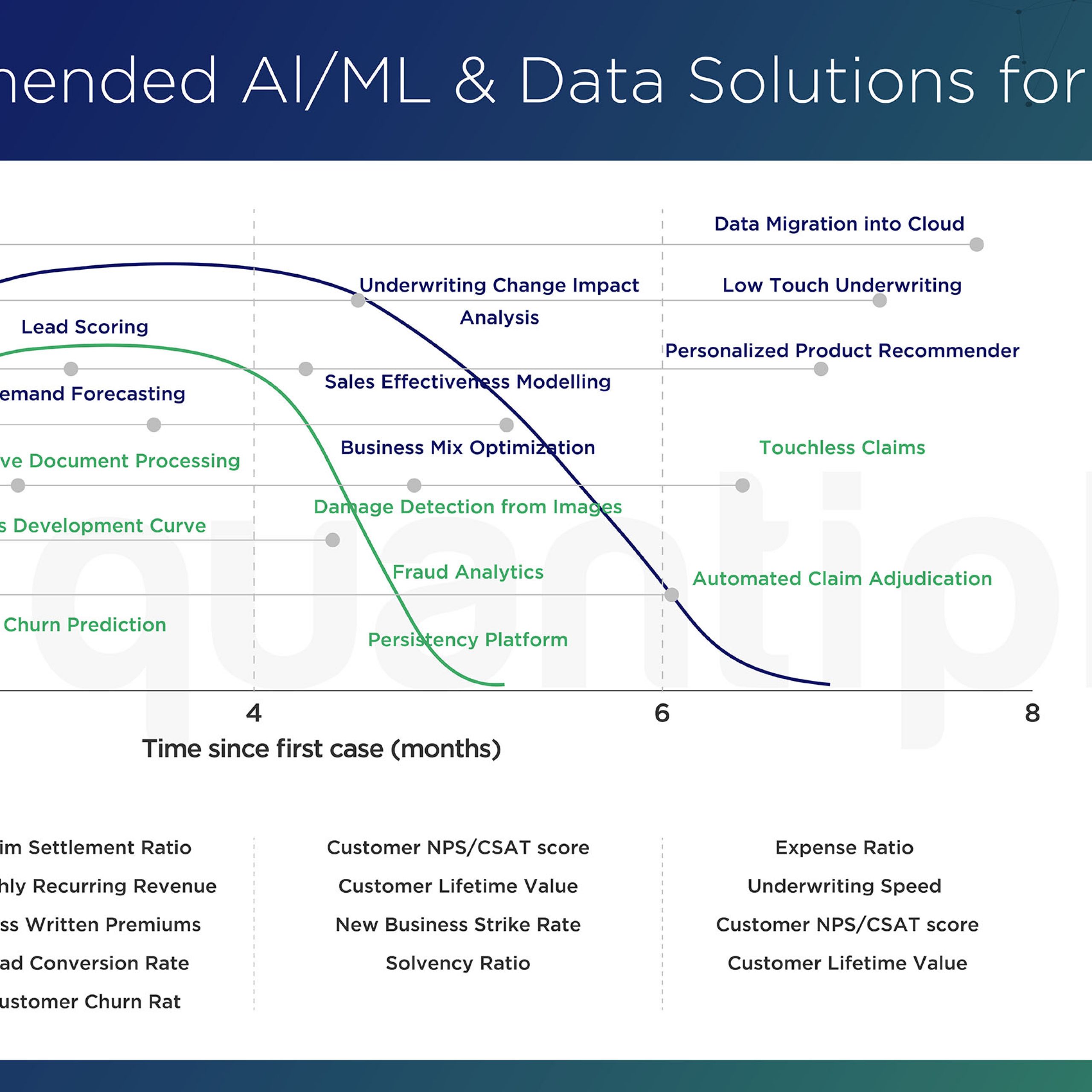

Digital Transformation Initiatives are usually broad multi-year programs involving large capital expenditures. In the current economic climate and uncertainty, most Insurance carriers will refrain from making large commitments and rightfully so. The need of the hour is to break down these initiatives into smaller realistic business outcomes that can result in immediate gains as we move along the COVID curve eventually, putting the larger digital footprint in place.

Advanced AI/ML and cloud-based solutions are the first lego blocks that need to be moved right now to make an immediate impact and there are multiple reasons for the same.

- Automated call center bots, agent assists, adjuster assists, and other deep learning-based AI/ML solutions can be developed and deployed in a few weeks (not months) resulting in immediate business impact

- These cloud-native based solutions are relatively less expensive and present an immediate ROI

- Finally, these solutions fit perfectly to the broader digital roadmap that will naturally take shape as the lego blocks are put in the right place.

The below illustration highlights some of the key AI/ML solutions that need to be prioritized as we move along with the COVID curve.

Time To Act

COVID 19 is having a ravaging impact on the world economy and society in general. We are seeing record unemployment numbers, small businesses all the way up to large conglomerates getting severely impacted, and above all the impact on human capital with the loss of thousands of precious lives. Yet from a digital perspective, COVID-19 presents itself as a Time Machine enabling the adoption of technology in business processes well ahead of its natural time. The Insurance industry must get on this Time Machine, move ahead in time, and make the much needed fundamental changes by leveraging AI/ML and data in general.

Many sci-fi franchises claim movement back in time using a Time Machine. While the jury is still out on its viability, maintaining the current status quo will surely push the Insurance industry back by a few time intervals!

Interested in taking the first step towards your AI-led transformation journey? Book a consulting session now!